FRIDAY, APRIL 4, 2025

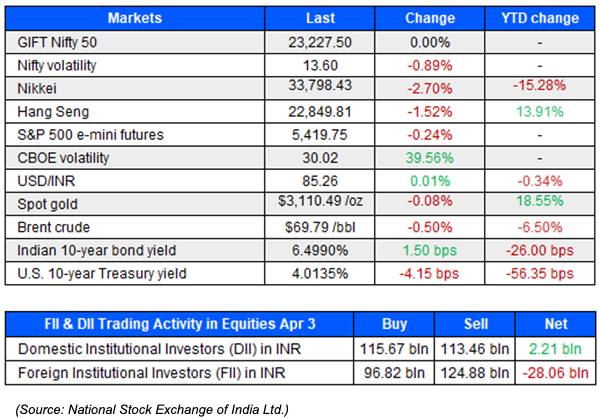

A day after Indian stocks endured U.S. President Donald Trump’s tariff storm better than their global peers , investors will continue to focus on specifics that could impact the domestic economy. Although the Nifty 50 fell 0.35% and the BSE Sensex lost 0.42% on Thursday, they performed better than most Asian peers , as analysts noted that relatively lower reciprocal tariffs on India compared to China, Vietnam and Thailand could offer a competitive edge.

Trump’s decision to temporarily exempt pharmaceutical products from the tariffs boosted the sector, with pharma stocks soaring 2.25%

Meanwhile, recession fears gripped Wall Street , with the benchmarks recording their biggest single-day percentage losses in years. Overnight S&P 500 companies lost a combined $2.4 trillion in stock market value as the benchmark logged its biggest one-day percentage decline since June 2020. Wild swings are expected in the near term, with the CBOE Volatility index , Wall Street’s fear gauge, closing above 30 points for the first time since August, indicating a period of higher volatility. The focus will be on the U.S. payrolls data and Federal Reserve Chair Jerome Powell’ s speech later in the day for crucial cues into the U.S. economy’s health and the interest rate trajectory.