BIOCON 393.8 down by -48.15 (-10.89%)

Reason #1

The sudden exit of its biologics’ Managing Director Christiane Hamacher over “professional differences” with the chairperson.

Reason #2

The company’s net profit declined 19% year-on-year to Rs 186.6 crore vs estimate Rs 243.1-crore. Its revenue rose 8% year-on-year to Rs 1,851 crore, aided by 11% and 13% growth in bio-similars and the research services business, respectively. The forecast was Rs 1,981.1-crores.

- Net Sales - QoQ Growth in quarter ended Dec 2020 is 6.09% vs 4.4% in Sep 2020

- Consolidated Net Profit - QoQ Growth in quarter ended Dec 2020 is -4.5% vs 16.45% in Sep 2020

https://www.tradingview.com/x/E5XsN3F4/

Day range. Rs. 423 - 376 .

Close price Rs. 393.75

Volume 28.41 M

Average Volume 5.57 M ( 10 days )

Biocon Ltd. is trading lower than 5 day, 20 day, 50 day, 100 day and 200 day moving averages

- 1 Month: Delivery volume fell by -23.79%

- 1 Day: Delivery volume increased by 646.52% over 5 day average

PE Ratio 85.

Held by 462 FIIs (17.65%)

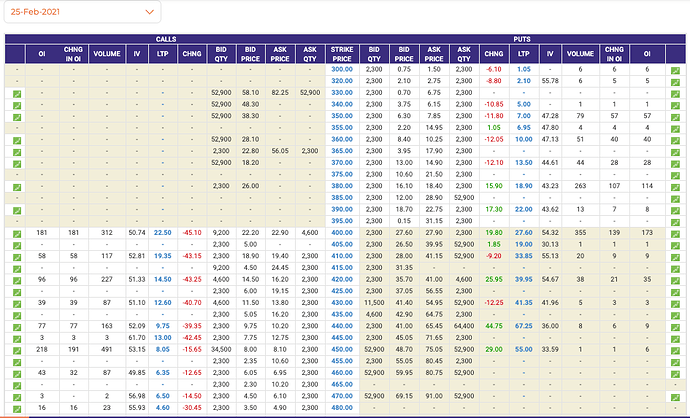

Options data.

FEB 2020 Series saw 249.52% increase in Open Interest.

|Market Lot|2,300|

|Open Interest (Contracts)|2,943|

|Change in Open Interest|2,101|

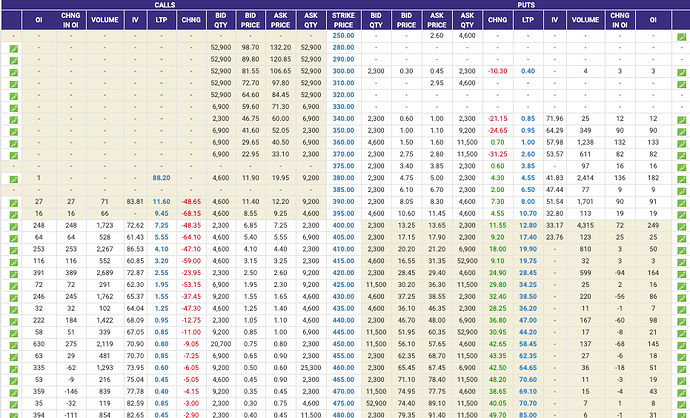

Options Data January Series.

|Open Interest (Contracts)|4,663|

|Change in Open Interest|-117|

|% Change in Open Interest|-2.45|

January Series ATM CE+PE nearly 20 Rs. 10 %

Trading days left. 3

Feb series ATM CE+PE = 50 Rs.

Jan Option Chain

Feb Option Chain